Klarna Casino

It’s 2020 and you’ve likely heard of Klarna; although you may not know exactly what it is. Klarna provides a payment option for around 80 million online shoppers, via 190,000 traders and across 17 countries. It is, in fact, one of the largest virtual banks in Europe and offers direct payments as well as alternative payment options such as instalment plans and buy now, pay later. The bank was founded in Sweden in 2005, aiming to create an easier environment for online shoppers and it has become increasingly popular since. Offering straight-forward, one-click purchases and the option to pay how you prefer to, it’s no wonder that Klarna sees on average 1 million transactions per day.

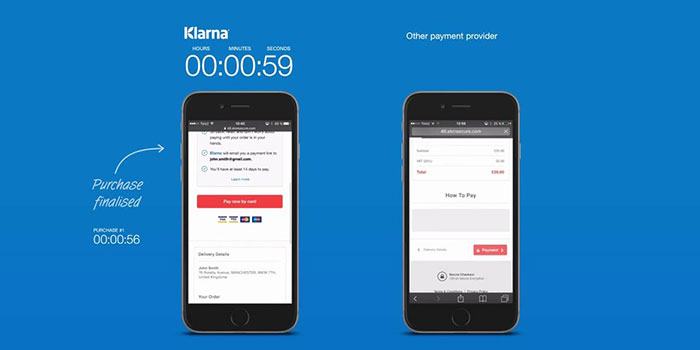

Klarna online casino payments are offered by the Swedish-based company that provides users with a convenient financial instrument to be relied upon online. Known for its “pay after delivery” system, this banking option also includes monthly plans and instant payments made straight from the bank account. Klarna is a popular payment method that allows users to pay later for services and to split the costs. Most commonly, it allows you to pay up to 30 days after processing the payment, and when you choose to “Pay Later in 3”, you pay one instalment 30 days after processing, and the final two payments 60 and 90 days after respectively. In order to top up a casino account with this company, players first need to make sure they have enough funds. They can pay in online or through the app using MasterCard or Visa. Next, it’s just a case of logging on to a casino account and selecting Klarna as a payment method. The process is very quick and funds are usually available immediately.

Klarna Casino Las Vegas

Established in 2005, Klarna is a 15-year-old online financial service that was founded in Sweden. As a versatile financial outlet, Klarna makes it possible to set up direct payments, pay for services, and withdraw funds all from the convenience of your phone.

Klarna is actually the name of a bank in Sweden: It is established in 2005 by Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson. However, while it has a banking license, it is not like any other bank you know: This one provides online financial services only (*). The company has nearly 3.000 employees and it is a very popular payment provider in Europe, especially in Sweden: Approximately 40% of all e-commerce sales in this country are made with Klarna. The bank also owns & operates SOFORT, which is another popular payment option.

Klarna Casino Utan Svensk Licens

So, how does Klarna work? More importantly, how to get accepted with Klarna? Let’s explain the concept of this payment provider step by step.

- Klarna has agreements with banks all over Europe. At the time of this article, it covered more than 5.000 banks in 16 countries around the world.

- In order to get accepted & start using Klarna, you need to have an account at one of these banks or a debit/credit card that is issued by one of these banks.

- You need to download & install the Klarna app (available for iOS/Android) to start using the service. When you launch the app for the first time, it will ask you to “connect” your bank account and/or credit/debit card.

- In other words, you will be paying with your bank account or credit card – Klarna will act as a middle man.

- However, you will be able to make payments in installments and take advantage of special offers available to Klarna users: That’s the main difference of Klarna. It allows you to pay “30 days later” or “in 4 interest-free payments”. Unfortunately, both options cannot be used for Klarna casino payments: We will explain this in detail below.

Klarna supports all currencies in the countries where it can be used. In this regard, it supports AUD, CAD, CHF, DKK, EUR, GBP, NOK, SEK, and USD.

(*) If you are curious, note that Klarna has an actual bank in Germany too: Since February 2021, it offers a classic bank account with an IBAN number and a VISA debit card. However, these services are available only in Germany at the moment.